The twin strategy of expanding dealer network and offering a range of products with longer warranties has paid off for Amara Raja Batteries, India's second largest battery maker.

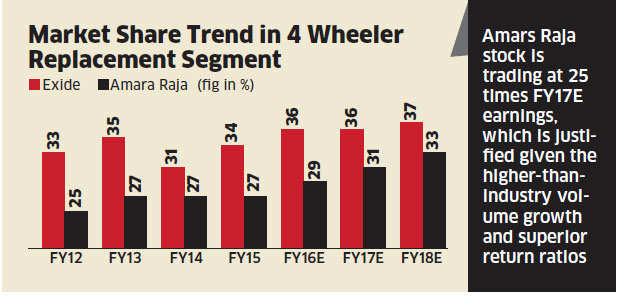

This has helped the company grow 5-10% more than the industry average in the past five years and expand market share. In the four-wheeler replacement market, which accounts for nearly 40% of the battery demand, the company's sales volumes rose 14.5% in each of the last two financial years — nearly double the average volume growth in the industry. Its market share in the segment rose to 30% in 2015 against 25% in 2012.

Analysts believe that the company's market share will rise another 3% by 2018. The stock has multiplied nearly nine times in the past five years, trading at 50% premium to its peers.

In the Rs 22,000-crore Indian battery market, customers prefer buying batteries from established players. This would lower share of the unorganised market over time. Accordingly, Amara Raja devised a strategy to tap latent demand by offering a range of products with a longer warranty to attract customers.

On one hand, the company's retail outlets touched 30,000 from less than 18,000 in 2012, products were priced 5-10% cheaper than the market leader, and sales incentives were raised. On the other hand, steps were taken to improve cost efficiencies.

The Amara Raja stock is trading at 25 times the projected FY17 earnings, which is justified.