Resources

through tender updates, knowledge papers,

market reports, case studies, webinars and

presentations.

Industry Reports

Deep dive into IESA knowledge products through market intelligence reports and emerging technology reviews

India Electric Vehicle Market Overview Report 2023

Policy framework to accelerate ES deployment in India

Report on Energy Storage Vision 2030 for India

India Electric Vehicle Market Overview Report 2020-2027

EV 101

Gain insight into the current EV market scenario, latest trends, forecast, and analysis

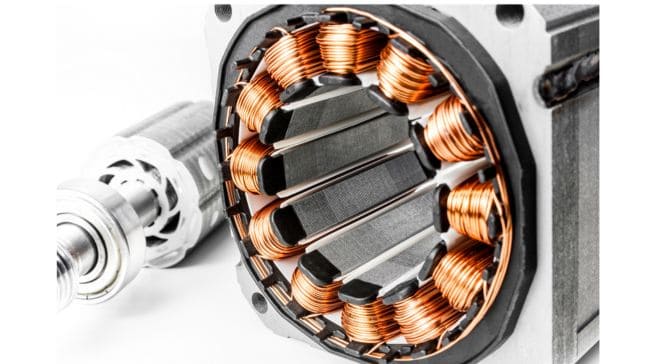

TYPES OF MOTOR USED IN ELECTRIC VEHICLES AND FUTURE TRENDS

The Evolving Landscape of Urban Air Mobility in India

Public EV Charging Infrastructure in India

Storage 101

Stay up-to-date with the current energy storage market scenario, latest trends, forecast, and analysis

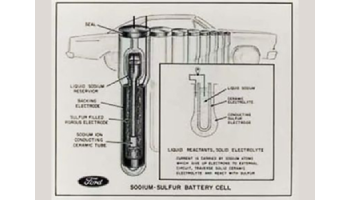

High temperature batteries: Workhorses for large scale grid storage

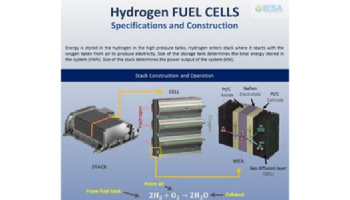

Hydrogen Fuel Cells: Evolving towards clean energy carriers

Pouch, Prismatic or Cylindrical: What’s your pick?

Partner Resources

Build your understanding of the market by accessing the latest partner reports on RE, e-mobility & energy storage

The Power of Batteries to Expand Renewable Energy in Emerging Markets

Status quo analysis of various segments of electric mobility and low carbon passenger road transport in India

Policy and Regulatory Environment for Utility-Scale Energy Storage: India

MNRE series guidelines

Stay ahead of the curve with access to 1000+ wide-ranging reports, case studies, knowledge papers and tender updates and more.

Opportunities

Get access to the latest tender information and updates of the energy storage sector

Presentations

Access strategic information, data & insights through the presentations made at IESA flagship events

Overview of ESS Tenders & Projects India at SESI 2021

India Stationary Energy Storage Market at SESI 2021

IMC 2021 Presentation by Kowthamraj VS

2nd roundtable AtmaNirbhar Bharat Energy Storage Manufacturing by Sarin Sundar

Knowledge Papers

Get high-quality research reports, white papers & perspectives on energy storage, RE & e-mobility sector

Knowledge Paper on Pumped Storage Projects in India

The need of Hybrids in Renewable sector

Energy Storage Applications - The Utility and Discom Perspective at World Utility summit (WUS 2020)

India Lead Acid Battery Market 2016 – 2020 (Stationary and Motive Applications)

Regulations

Learn about the comments & industry inputs given by IESA and its members on policies and regulations

Request to consider exemption of BCD on the lithium-ion cell used in the Manufacturing of Battery/ Battery Pack related to EV and storage applications

IESA inputs/suggestions on the “Draft Battery Waste Management Rules, 2022”

Letter to Shri Prakash Javadekar for the approval for ACC Manufacturing Plan

Letter to MOP - IESA inputs on draft National Electricity Policy’2021

Working Group

Get high-quality information including issue briefs from policy working group meetings, presentations at virtual roundtables, and webinars

PWG meeting, 03-10-2023

7th Knowledge Series webinar on Solar + Energy Storage

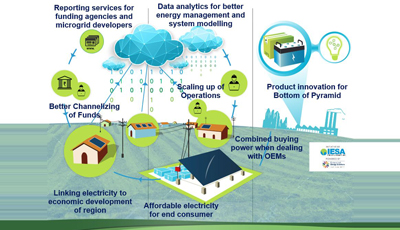

Case Studies

Explore case studies that help achieve the pathway to a greener grid and cleaner transportation

Diesel Optimization

Wind curtailment

Port Blair, Andaman

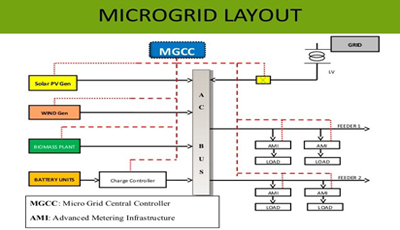

Role of Energy Storage in Micro-grid systems

Microgrids in India